One

of my idolized investors of all time, Warren Buffett, has a pretty exciting

portfolio position for his holding company Berkshire Hathaway. I'm always

following his latest investment move, and to my surprise, I found out that one

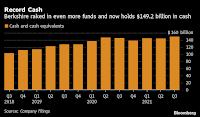

of his largest positions is cash on hand. According to the company's earnings

announcement on Saturday, Berkshire Hathaway's cash hoard topped $149.2 billion in

the third quarter, exceeding a previous high established in early 2020.

The new

high came despite Buffett pouring more money into stock repurchases, with $7.6

billion in repurchases in the quarter, the third-highest total since the board

modified its buyback strategy in 2018. This is an exciting topic to point out.

There must be a reason why Warren Buffett is piling up cash in his portfolio

instead of buying new stocks. In this

article, I will talk about my opinion on why Warren Buffett is just piling cash

in the Berkshire Hathaway portfolio. Moreover, I will talk about how this

answers my father's large cash balances in his portfolio.