I always thought

that to become wealthy, you will need to invest. Furthermore, the annual

returns from your portfolio determine how much wealth you can build. But I

realize something more important than performing great in the investment world.

This does not require knowledge about the financial world, but it is more of a

character and discipline. Yes, it is indeed true that investment return is

essential to building wealth.

Nevertheless, this

primary method is the most crucial factor in successful investing. Do you want

to know what it is? Your

discipline and determination of how much you are willing to save up each month

from your income is the most important factor in becoming wealthy. This article

will talk about why the saving rate is the most critical factor to building

wealth. I will also talk about how the saving rate is why I can become wealthy

today.

Your Saving Rate is the Most Basic Thing You will have to do

first.

Before talking about investing in the stock market or rental properties, you'll need to know the most critical factor to building wealth: how much you are saving each month. Your savings rate is the percentage of your total or gross income that you keep each month. A greater savings rate translates to more considerable monthly savings. The more money you save each month, the more you can save for retirement, a down payment, an emergency fund, or any other savings objective you may have.

It doesn't matter if you are making $100,000 or more annually if you are spending almost everything of it. I see many people I encounter in my life having trouble building wealth. This is not because they are not hardworking or intelligent, but it's more discipline in oneself.

Before you want to start investing, you'll need to manage your personal finance first. You need to know how much income you are making each month, how much you have to spend each month, and lastly, how much you can invest with the money you save. The more money you can save each month, the more capital you can invest. Many people have a hard time doing this because they are not determined to live modestly and delay their gratification to achieve a higher saving rate.

Before talking about investing in the stock market or rental properties, you'll need to know the most critical factor to building wealth: how much you are saving each month. Your savings rate is the percentage of your total or gross income that you keep each month. A greater savings rate translates to more considerable monthly savings. The more money you save each month, the more you can save for retirement, a down payment, an emergency fund, or any other savings objective you may have.

It doesn't matter if you are making $100,000 or more annually if you are spending almost everything of it. I see many people I encounter in my life having trouble building wealth. This is not because they are not hardworking or intelligent, but it's more discipline in oneself.

Before you want to start investing, you'll need to manage your personal finance first. You need to know how much income you are making each month, how much you have to spend each month, and lastly, how much you can invest with the money you save. The more money you can save each month, the more capital you can invest. Many people have a hard time doing this because they are not determined to live modestly and delay their gratification to achieve a higher saving rate.

Why Is Your Savings Rate Important?

Why is your savings rate perhaps one of the most crucial aspects of your financial plan? It's the aspect over which you have the most control. You have little influence over market returns or how long you live, but you do have power over how much money you spend and save.

In the seminal book, "The Seven Habits of Highly Effective People," Stephen R. Covey refers to this as our "circle of influence." Covey highlights in his book the significance of focusing on the things that fall within our spheres of influence rather than wasting energy on those that do not. Your capacity to control spending and raise your income has a big impact on your savings rate. So, instead of focusing on what the market is doing, concentrate on your savings rate, and you'll be well on your way to achieving your financial objectives.

Your savings rate is one of the most important elements in determining whether you will have enough money to last through your retirement years, and it is something you have a lot of control over. A higher savings rate means you'll be able to retire sooner or have more money throughout your golden years. Or both, perhaps.

Saving Rate is More Important than Investment Return.

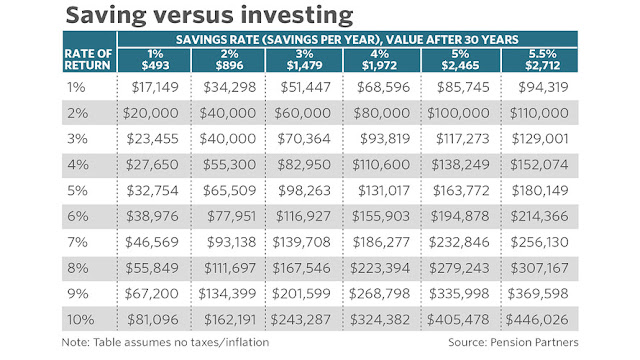

It's only natural for investors to seek assets with the best potential returns and lowest costs. However, according to Pension Partners experts, the trick to accumulating wealth has less to do with returns and more to do with your savings rate. In other words, the amount of money you put into your retirement fund is considerably more essential than the investment vehicles in which it is held because the former is under your control while the latter is not.

Intuitively, it makes sense. Saving $20,000 per year will grow your money far more quickly than saving $10,000 per year. However, even small improvements in the savings rate have a significantly greater impact than equal increases in the rate of return. To demonstrate the importance of saving versus investing, Charlie Bilello, director of research at Pension Partners LLC, calculated what would happen to your wealth if you increased your savings rate by 1% and what would happen if your portfolio's rate of return grew by 1%.

While a 10% average return appears high, it is not out of the realm of possibility, especially given that the S&P 500 SPX, +0.08%, has averaged double-digit yearly returns for the past eight years. According to Blair Duquesnay, chief investment officer at ThirtyNorth Investments, a New Orleans–based independent registered adviser, a ten percent average yearly return over the next decade is undoubtedly ambitious.

"We got big gains over the last eight years to compensate for a 40% decrease in the stock market during the financial crisis of 2008," Duquesnay explained. "The next ten years are unlikely to repeat the previous ten."

Duquesnay analyzes hypothetical scenarios with clients to illustrate the long-term consequences of various rates of return versus greater savings levels.

"A lot depends on when and how much money someone wishes to retire on." However, the earlier you begin saving, the better, because compounding occurs in the second and third decades," according to Duquesnay.

Bilello acknowledged the difficulties of saving for the future, which he claims necessitates discipline and difficult decisions. According to studies, those who are willing and able to save have more power over their money than they think.

My Saving Rate was the Reason Why I Became Wealthy!

Yes, it's indeed true that my father gave me a total starting capital of $350,000, to begin with. But that's not the only reason why I became wealthy today. Despite working for a minimal wage of Rp25,000,000 ($1700/month) in my father's company, I was still able to become a millionaire by the age of 30. I lived below my mean for an extended period and invested most of my income each month. If it wasn't for me doing this, I wouldn't be the millionaire I am today.

At the beginning of my early 20's, I was saving most of the income I received from working in my father's company. But as I grew to my late 20's, I became easier on myself. Instead of investing 80% of my income just like I was in my early 20's, I increased my spending budget to about 60% of my monthly income. If I wasn't more aggressive regarding my saving rate during the beginning of my career life, I wouldn't be able to amass the kind of personal wealth I have right now. It was a very challenging moment of my life, truthfully. However, I believe I am satisfied with my determination and discipline. Because of this reason, I now have a large capital that I can invest in the stock market despite only putting about 40% of my monthly income to invest now.

I am easier on myself now regarding saving money. I'm still earning the same wage working in my father's company. However, because of the sacrifice I made in my early 20s, I'm still able to build wealth with the money I saved up. I'm able to spend more on things I need and like. For example, I could purchase so many clothes to the point my closet is cluttered. I was also able to purchase the watches I have in my collection.

My friends always complain that I was too harsh about my spending habit. Yes, it's indeed true that I was kind of frugal with myself during my early 20's. However, if I didn't do the things I did when I was still young, I wouldn't live more comfortably now. I am planning to increase my monthly spending budget soon.

The Discipline to Save More leads me to become a Savvy Bargain Hunter!

I became a great bargain hunter because I had a very small monthly budget. During my early 20s' when I was still investing the majority of my income, I needed to be very strict with my spending budget. I wasn't able to do a lot of leisure things I liked. I have the skills to find the best deals for my needs. For example, instead of getting a haircut at a Saloon, I found a barbershop located in the mall that charges only about 30% lesser compared to a haircut in the saloon. In addition, I am constantly purchasing things wholesale instead of paying retail for items.

I needed to be creative with my spending since I am trained to be more cautious. I consider myself a lazy person since I only work as a freelancer in my father's company. But because I am a savvy buyer, I was able to live on a tight budget. It was quite fun since I needed to spend my money creatively.

Am I able to Retire Now Due to My Early Age Decision?

Let's say I decided to quit working in my dad's company; how much passive income can I get each month without working. With the personal net worth I have right now; I'm able to retire now if I want to. As of January 2022, my net worth is approximately $1,300,000 USD if I combine my United States and Indonesia assets. The CDs in Indonesia yield about 6% annually. If I have all my assets in the CD's account, I would receive passive income of $66,300 USD annually (After a 15% Tax Deduction). That's about $5,525 USD a month! I don't know if that's enough for me to retire in the United States; however, I'm pretty sure it's more than enough to retire in Jakarta, Indonesia. Yes, I will receive this much passive income every month if I retire now! This is without spending any of the principal amounts.

However, I am not looking forward to retiring right now. I still want to keep building my wealth because I want to live a better lifestyle in my 40s. But I will increase my monthly spending budget slowly as I grow older. I feel more financially secure when I have my wealth of my own. I know my parents are well off; however, the feeling of controlling my own finances is great. I don't have to worry about my future if anything happens to my father's business.

Moreover, I don't have to worry about whether I will inherit my parents' wealth if they pass away. I have money of my own, and I want to make my own decision as I grow older. I like the feeling of becoming financially independent and having the freedom to make my own decision in my life.

Bottom Line

I hope this article explains why your saving rate is more important than your investment return. Yes, your annual investment return is crucial to building wealth, but without having you contribute a larger amount of your saving rate, you won't have the money to invest in the first place. I'm glad that I followed my financial plan early when I started working in my father's company in my early 20s. If I didn't do the things I did, I wouldn't be the millionaire I am today.

I am not planning to retire now, even if I can do that. I still want to keep building my wealth to live a better lifestyle once I hit my 40s. I don't want to rely on my parents' wealth, and I like the feeling of being in control of my finances. I'm blessed with whatever my father gave me already and not expecting more from him. I hope this article can inspire readers to save money and invest more of it during the early age of their career life. It's going to be worth it!

I really admire how Peru Journal transforms headlines into engaging stories. Its coverage of Peruvian culture, travel destinations, and lifestyle trends keeps readers informed while providing inspiration, making it a reliable and enjoyable source of knowledge.

ReplyDeleteI really admire News Loss for its ability to deliver smart, relevant, and engaging content. The website provides thoughtful insights on important stories, making it a go-to source for readers who want clarity and perspective on current events.

ReplyDeleteI truly appreciate Spain Journal for consistently delivering fresh insights into technology and trends. Its well-researched content keeps readers engaged and informed, making it a must-visit platform for anyone wanting to stay ahead in the fast-paced tech world.

ReplyDelete